Comparing car insurance is an essential part of ensuring you get the best coverage for your needs at an affordable price. Understanding the nuances between different policies, coverage levels, and premiums can save you both money and potential headaches in the future. In this article, we will delve into various aspects of comparing car insurance, highlighting what to consider when analyzing different policies.

First and foremost, it's crucial to understand the terms and components that influence car insurance comparisons:

- Coverage Types: Car insurance policies typically include liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage. Each type serves a different purpose and protects against various risks.

- Premiums: This is the amount you pay for your insurance policy, and it can vary significantly between companies. Factors influencing premiums include your driving record, age, type of vehicle, and location.

- Deductibles: A deductible is the amount you agree to pay out of pocket before your insurance kicks in during a claim. A higher deductible usually results in lower premiums, but it also means paying more up front when filing a claim.

- Discounts: Many insurers offer discounts for various reasons, including safe driving records, bundling policies, good student discounts, and membership in certain organizations. Research these discounts to maximize your savings.

- Claims Process: The ease and efficiency of filing a claim can vary between insurers. Look for customer reviews and ratings regarding the claims process to ensure you're choosing a company known for good customer service.

To effectively compare car insurance policies, it’s also important to gather quotes from multiple insurance providers. This can typically be done online, with many insurers providing instant quotes based on the information you provide. Here are some steps to facilitate this process:

- Gather Personal Information: Prepare necessary details such as your driver's license number, vehicle identification number (VIN), and information about any previous insurance policies.

- Check Coverage Needs: Assess the level of coverage you need based on your vehicle's value, how often you drive, and any personal preferences you may have regarding risk.

- Use Comparison Tools: Take advantage of online tools that allow you to compare quotes side by side. This will simplify the analysis of what's included in each policy.

- Review Policy Details: Beyond premium costs, assess what each policy covers. Pay close attention to the limits and exclusions that may apply.

Ultimately, the goal of comparing car insurance is to strike a balance between affordability and adequate coverage. You want to ensure that you’re not underinsured, which can lead to significant out-of-pocket costs in the event of an accident. Conversely, paying for unnecessary coverage will lead to wasted premiums.

Average Car Insurance Cost For 25 Year Old Male Woolworths

This chart illustrates the varying costs of car insurance by age, indicating that younger drivers often face higher premiums due to statistical risks associated with their demographic. Understanding these trends can better inform your decision-making process.

Usage-based Insurance

Usage-based insurance plans are becoming increasingly popular. These programs assess individual driving behavior and provide premiums based on risk. If you’re a safe driver, usage-based insurance may yield significant savings compared to traditional policies.

Coverage Levels

This chart demonstrates the various levels of coverage available, emphasizing the importance of choosing a policy that fits your comfort level regarding risk and your financial situation.

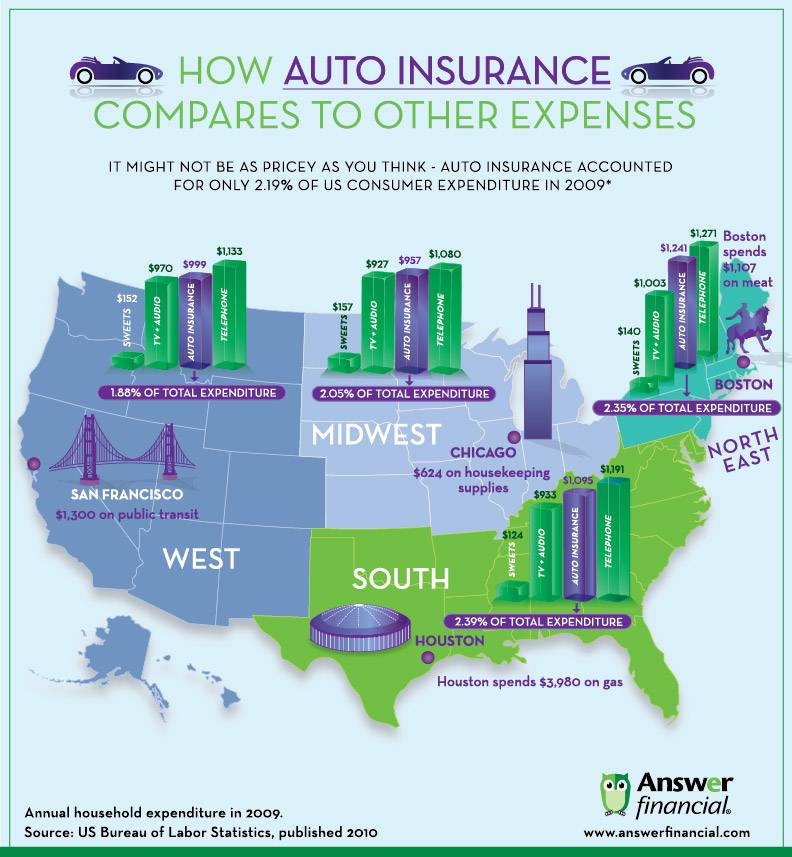

How Auto Insurance Compares

Gradually build a thorough understanding of how auto insurance policies stack up against each other. This visual representation can help you understand the complexities involved when evaluating different offers.

1. What factors influence the cost of car insurance premiums?

The cost of car insurance premiums is primarily influenced by several key factors: the driver's age, driving history, type and age of the vehicle, location, and coverage level selected. Young drivers often face higher premiums due to their inexperience on the road, while drivers with clean records typically pay less. Additionally, vehicles with safety features may qualify for lower rates, whereas cars that are more expensive to repair or in higher theft categories could lead to increased premiums.

2. How can I lower my car insurance premiums without sacrificing coverage?

Lowering your car insurance premiums without sacrificing coverage can be achieved through a variety of strategies. One effective method is to compare multiple insurance providers to find the most competitive rates. Additionally, increasing your deductible can reduce premiums, although this means more out-of-pocket expenses in the event of a claim. Maintaining a good driving record, taking advantage of available discounts, and considering usage-based insurance options are also prudent strategies for reducing costs.

3. Why should I consider reviewing my car insurance policy annually?

Reviewing your car insurance policy annually is essential for several reasons. First, your insurance needs may change due to life events such as moving, getting married, or purchasing a new vehicle. Additionally, insurance providers periodically adjust their rates based on market conditions and individual risk assessments. By reviewing your policy, you can explore potential savings, ensure you have the appropriate coverage, and avoid overpaying for insurance no longer suited for your needs.

In conclusion, comparing car insurance is a necessary endeavor that can help consumers make informed decisions regarding their coverage. By understanding the factors involved, gathering multiple quotes, and regularly reviewing your policy, you can confidently navigate the complexities of car insurance to find the best option for your circumstances.