Car insurance is a crucial part of vehicle ownership, providing financial protection in the event of accidents, theft, or damage. However, with numerous providers and varying policies, it can be overwhelming to determine which car insurance quote is the best fit for your needs. Comparing car insurance quotes is not just a task; it's a strategic approach to ensuring that you're receiving the best value for your money. As we delve deeper into the process of comparing car insurance quotes, we will explore various aspects and guidelines to make this crucial decision easier. Here are some key points to consider when comparing car insurance quotes:

- Understanding Coverage Types

- Liability Coverage: This is the minimum requirement in most states, covering damages to other people and their properties in case of an accident.

- Collision Coverage: This insurance type covers repairs to your own vehicle after an accident, regardless of fault.

- Comprehensive Coverage: It provides protection against theft, vandalism, and natural disasters, covering incidents beyond collisions.

- Uninsured/Underinsured Motorist Coverage: This offers safety against drivers who lack insurance or don't have enough coverage to pay for your damages.

- Factors Influencing Insurance Quotes

- Your Location: Rates differ by state and even city, influenced by factors such as traffic density and accident frequency.

- Your Driving Record: A clean driving record usually leads to lower premiums, while accidents and violations have the opposite effect.

- Type of Car: The make, model, and year of your vehicle play a significant role in determining the cost of your premiums.

- Your Age and Gender: Younger drivers, especially males, often face higher rates due to statistical risk factors.

- Credit Score: Many insurers consider credit history and utilize it as a factor in setting premiums.

- Gathering and Comparing Quotes

- Consult Multiple Providers: Don't settle for the first quote; obtain estimates from various insurers to analyze differences.

- Use Online Comparison Tools: Websites such as The Zebra and Insurify can allow you to compare multiple quotes simultaneously.

- Check for Discounts: Inquire about potential discounts, such as bundling insurance policies, good student discounts, or safe driver credits.

- Understand the Fine Print: Always read the policy details to understand what is covered and what isn't, as well as any caps on coverage.

- Evaluating the Financial Stability of the Insurer

- Check Ratings: Refer to organizations like A.M. Best or Standards & Poor’s that rate insurers’ financial stability.

- Research Customer Reviews: Look at customer feedback and complaints available on various platforms to gauge service quality.

As you progress through evaluating and comparing various quotes, knowing how to analyze each quote will ultimately empower you to make an informed decision. The goal is not just to find the cheapest option but to ensure that the coverage suits your needs and that you are working with a reliable company.

1. What essential factors should I consider when comparing car insurance quotes?

To effectively compare car insurance quotes, consider coverage types, personal factors like location and driving history, additional discounts, and the financial stability of the insurance provider. Analyze these attributes in relation to your individual needs and circumstances to make an informed decision. Each of these factors plays a significant role in establishing the right insurance plan that ensures both affordability and adequate protection.

2. How can I ensure I’m getting the best deal when comparing car insurance quotes?

To ensure you are getting the best deal on car insurance quotes, you should gather multiple quotes from a range of providers to compare prices and coverage. Pay close attention to distinct features of the policies, including deductibles, limits, and exclusions. Additionally, checking for available discounts, using online comparison tools, and researching the company's customer service and claims process will help you identify the most favorable deal.

3. What should I do if I find a lower car insurance quote offering similar coverage?

If you find a lower car insurance quote with similar coverage, assess the provide policy deeply to ensure it matches your needs regarding deductibles and limits. Contact your current insurer with the lower quote as leverage to discuss potential reductions on your existing premium. Insurers often prefer to retain customers and may offer lower rates to match or undercut competitors. Always ensure the lower quote doesn't compromise essential coverage for cost savings.

In conclusion, comparing car insurance quotes is a crucial process that involves understanding your options, considering various influencing factors, and evaluating the best providers. Armed with the right knowledge, tools, and strategies, you can navigate this complex landscape and make a confident choice that secures both effective coverage and financial savings.

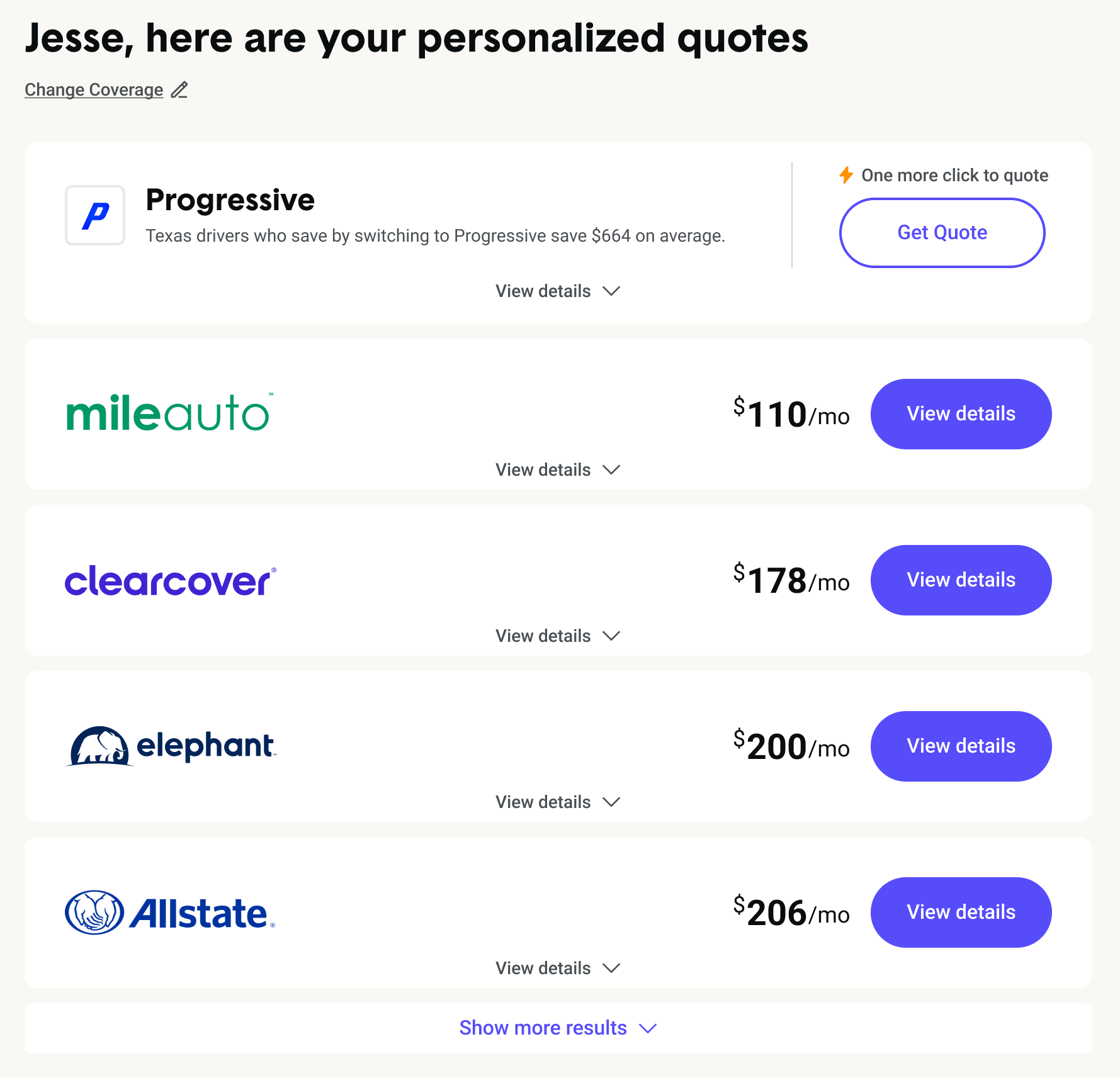

Compare Car Insurance Rates From $57/mo (November 2023)

This image illustrates the available car insurance rates as of November 2023.

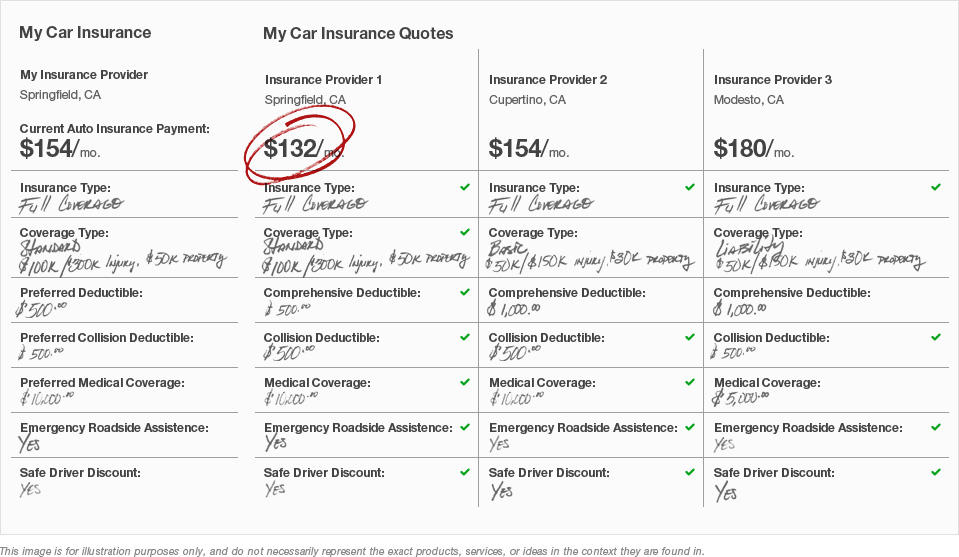

Compare Car Insurance Rates Side-by-Side in 2023 | The Zebra

This image provides a visualization of how car insurance rates can be compared side-by-side for better understanding.

Best Car Insurance Quotes Comparison – Financial Report

This image depicts a report comparing the best car insurance quotes available.

Car Insurance Quotes Comparison - Security Guards Companies

This image represents a comparison of car insurance quotes specific to security guard companies.

Home Insurance Quotes | Save up to £225 | Compare the Market

This image showcases a platform for comparing home insurance quotes, which is also integral to overall insurance management.

How To Compare Car Insurance Quotes | EINSURANCE

This image serves as a guide on the methods and practices to compare car insurance quotes effectively.