In the ever-evolving landscape of auto insurance, understanding the nuances of car insurance comparison becomes vital for consumers looking to save money and secure the best coverage. The primary goal of comparing car insurance options is to identify the policy that not only fits one's financial constraints but also adequately meets their unique coverage needs. There are numerous factors to consider when comparing auto insurance rates and policies, and each plays a critical role in the decision-making process.

When embarking on the journey of car insurance comparison, here are some essential aspects to consider:

- Coverage Types: Understand the various types of coverage, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). Each type has distinct advantages and can significantly impact your premium rates.

- Premium Rates: Obtain quotes from multiple insurers to compare their premium rates. This involves providing similar information to each insurer for an apples-to-apples comparison.

- Deductions and Discounts: Investigate potential discounts for safe driving, bundling policies, or having a clean driving record. Some providers also offer discounts for safety features in your car.

- Claims Process: Investigate the claims process of each insurance provider. A straightforward claims process can save you time and stress during a difficult situation.

- Customer Service: Research customer service ratings and reviews. Choosing a provider that offers reliable customer support can enhance your experience.

- Financial Stability: Check the financial strength of the insurance company through ratings from agencies like A.M. Best or Standard & Poor’s. This indicates their ability to pay claims.

Compare ALL Car Insurance Sites - App on the Amazon Appstore

Utilizing applications and online platforms can simplify the process of comparing car insurance options. Many apps allow users to input their information and receive quotes from various providers, making the task less time-consuming and more efficient.

Who Has The Best Home Insurance Rates In Ontario – Haibae Insurance Class

Similar to car insurance, home insurance can also be compared using dedicated platforms. Graphs and statistical visualizations can help consumers identify which providers offer the best rates in their local areas.

Car insurance comparison sites could be charging you £200 MORE than you

Many consumers may not realize that some comparison sites have hidden fees or can influence premium rates. It is essential to be cautious and ensure that you are comparing products that are indeed the same or very similar.

How Auto Insurance Compares | Car Insurance Guidebook

Understanding how various providers stack up against one another involves looking closely at their policy offerings, pricing structures, and customer satisfaction ratings. This helps consumers make informed decisions.

Car Insurance Costs by State | Money

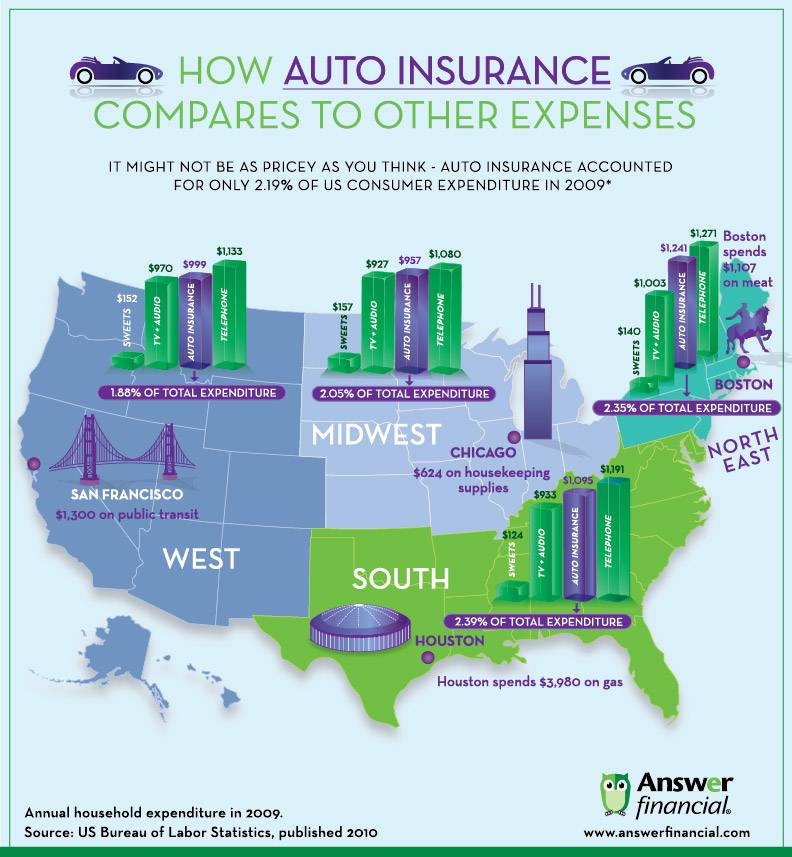

Insurance costs can vary widely from state to state. Factors such as local laws, accident rates, and weather conditions can influence these variations, making it crucial for consumers to consider regional differences when comparing rates.

Rates Compare Insurance Online Auto - Financial Report

The rise of online insurance comparators has transformed the way consumers evaluate and purchase insurance. With just a few clicks, one can view a range of options side by side, streamlining the selection process.

In conclusion, effectively comparing car insurance is not just about scraping the surface. It requires thorough research, a comprehensive understanding of policy features, and an awareness of market dynamics. By examining coverage types, premium rates, available discounts, claims handling, customer service quality, and financial stability, consumers can make informed decisions that lead to optimal coverage at competitive prices.

1. What are the key factors that influence car insurance rates?

Car insurance rates are influenced by several key factors, including the driver's age, driving history, credit score, vehicle make and model, geographic location, and the chosen coverage options. Insurers assess these attributes to evaluate the level of risk associated with insuring the driver, which ultimately determines the premium amount.

2. How can drivers effectively lower their car insurance premiums?

Drivers can effectively lower their car insurance premiums by maintaining a clean driving record, qualifying for discounts through safety features, bundling insurance policies, increasing their deductible amounts, and regularly comparing quotes from multiple insurance providers to find better rates.

3. What methods are available for accurately comparing different car insurance policies?

Accurate comparison of car insurance policies can be achieved through online comparison tools, requesting quotes from various insurers using the same criteria, evaluating coverage limits and exclusions, and analyzing customer reviews to assess satisfaction levels with claims handling and service quality.